Mobile money services have become essential, especially in areas where traditional banking is less accessible. MTN MoMo Payment Service Bank (PSB) is one of MTN Nigeria’s most impactful solutions, aimed at promoting financial inclusion across the country. This service allows individuals to manage their finances using just a mobile phone, transforming the way people save, transfer, and access funds.

In this post, we’ll explore what MTN MoMo PSB is, how it works, its benefits, and why it’s changing the financial landscape in Nigeria.

What is MTN MoMo PSB?

MTN MoMo PSB, short for MTN Mobile Money Payment Service Bank, is a digital financial service that offers secure, easy-to-access banking solutions to both MTN subscribers and non-subscribers. Designed to provide basic banking services to underserved populations, MoMo PSB offers mobile banking, money transfers, bill payments, and savings—all from a mobile phone.

The service doesn’t require a traditional bank account, making it accessible to individuals in rural or remote areas, as well as those who don’t currently have a bank account. This model of mobile banking brings essential financial services closer to Nigerians, supporting the Central Bank of Nigeria’s mission of achieving a more financially inclusive society.

How Does MTN MoMo PSB Work?

MTN MoMo PSB works primarily through mobile phones and can be accessed using both USSD codes and the MoMo PSB app. Here’s how to use it:

- For USSD Access: Dial *671# on any network, whether you’re an MTN user or not, to access MoMo PSB services.

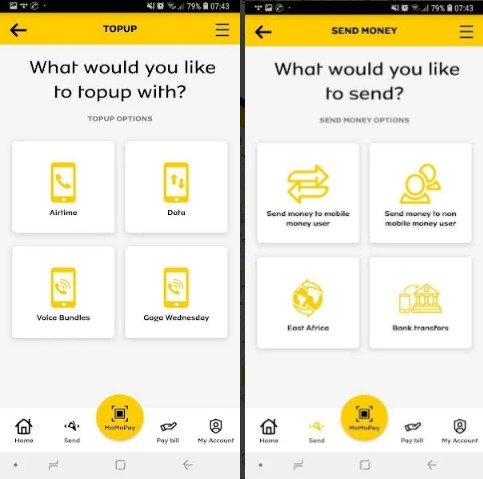

- Using the MoMo App: Download the MoMo PSB app on your smartphone. The app offers an intuitive interface for managing transactions, checking balances, and more.

With these tools, users can perform basic banking tasks like sending money, receiving payments, and paying bills without needing a traditional bank account or internet connectivity.

Key Services Offered by MTN MoMo PSB

a. Money Transfers

MoMo PSB allows users to send and receive money with ease. Transfers can be made between MoMo accounts, other mobile wallets, and even directly to traditional bank accounts. This flexibility makes it easy to manage funds, whether for personal or business needs.

b. Bill Payments

Users can pay for a variety of services, from utility bills to subscriptions, using MoMo PSB. With a few taps, you can settle electricity bills, TV subscriptions, and even government fees, all from your phone.

c. Airtime and Data Purchases

MoMo PSB also allows for the direct purchase of airtime and data for any network in Nigeria, offering convenient top-up services for MTN users and customers on other networks.

d. Savings and Deposits

MTN MoMo PSB encourages saving by providing users with safe and accessible ways to deposit funds into their MoMo account. This money can be stored digitally, reducing the risk of theft or loss compared to cash handling.

e. Withdrawals and Agent Network

Users can withdraw cash from their MoMo account through MoMo agents. This network of agents is strategically spread across Nigeria, particularly in regions where traditional bank branches may not be available. Customers can withdraw cash from agents or even ATMs by generating a code via USSD or the MoMo app.

Benefits of Using MTN MoMo PSB

a. Financial Inclusion

One of the primary goals of MoMo PSB is to promote financial inclusion, allowing unbanked Nigerians to access essential banking services. With MoMo PSB, anyone with a mobile phone can have a digital wallet, empowering people to save and manage money securely.

b. Ease of Access

MoMo PSB is simple to use, accessible via USSD and mobile apps, and does not require an internet connection. This design ensures that even users in areas with limited internet connectivity can benefit from financial services.

c. Secure Transactions

MTN MoMo PSB prioritizes the security of users’ money and information. Transactions are protected with PINs, and users are encouraged to safeguard their PINs, ensuring only authorized transactions occur.

d. Wide Network of Agents

MTN has invested heavily in expanding its agent network across Nigeria. With numerous agents in urban and rural locations, MoMo PSB users can easily deposit or withdraw funds without traveling far.

e. Low-Cost Services

Compared to traditional banking services, MoMo PSB offers affordable transaction rates. Users enjoy the benefits of banking without the high fees associated with traditional banking.

How to Get Started with MTN MoMo PSB

Here’s a step-by-step guide to getting started with MoMo PSB:

- *Dial 671# on your mobile phone or download the MoMo PSB app from the Google Play Store or Apple App Store.

- Follow the prompts to set up your MoMo PSB wallet. If using the app, provide the necessary information to register.

- Set a secure PIN to protect your transactions.

- Start using your MoMo PSB wallet for transfers, payments, and savings.

For additional services like cash withdrawals or deposits, locate a nearby MoMo agent to assist with in-person transactions.

Frequently Asked Questions about MTN MoMo PSB

Q1: Can non-MTN users use MoMo PSB? Yes, MoMo PSB is available to users on any network in Nigeria.

Q2: Do I need a smartphone to use MoMo PSB? No, you can access MoMo PSB services via the USSD code *671# on any mobile phone.

Q3: Is it safe to store money in my MoMo PSB wallet? Yes, MTN has implemented strict security measures to ensure your funds are safe. Always keep your PIN confidential to secure your account.

Q4: Are there limits on how much I can transact with MoMo PSB? Yes, MTN MoMo PSB has transaction limits that depend on regulatory requirements. Check with MTN or the MoMo app for current limits.

Conclusion

MTN MoMo PSB is transforming the financial landscape in Nigeria by offering a secure, accessible, and convenient way to manage money. Its features make it ideal for individuals who may not have access to traditional banking, and with the broad agent network and user-friendly USSD services, it’s an empowering tool for millions of Nigerians. Whether you’re looking to transfer money, save, or pay bills, MoMo PSB makes it easy to access essential financial services anytime, anywhere.

Take advantage of MTN MoMo PSB and experience the benefits of mobile banking in Nigeria.